There two sides - broadly the academics and the active investors who vehemently disagree on this hypothesis. The former who have indeed proved that most of the market participants can't beat the stock market and hence go on to say that market is efficient. Businessmen and thought leader like John Bogle went a step further and built on this idea in his thesis on the topic of investment performance and went on to make a hugely successful venture Vanguard which now manages about USD 6 trillion and counting on the basis of his thesis thus validating it an a way no one can really deny it. On the other hand, we have people like Benjamin Graham and his students like Warren E Buffett ( one among many of his students but possibly the foremost) who made it their life time goal of exploring every inefficiency in the market to create superlative returns over such a long period that it cannot be said that the market is efficient.

The people who propagated both sides of these ideas are not fools. They are highly intelligent people who have gone on to produce great value out of their idea. But the issue is that the academia is still at loggerheads and this issue is still largely unresolved leading to confusing things being taught in MBA classrooms to future practitioners. Academia did try to reconcile successes of the polar opposite approaches of Bogle and Warren Buffett by coming up with strong, weak and semi-strong efficient market hypotheses but there needs to be a better explanation.

What can India add to the EMH ?

India is an old civilisation. It reached its earlier zenith much before the industrial revolution and evolution of the stock markets and has been playing catch up with the West in thinking on industrialisation and capital markets.

However Indian logic is old, more complex and well established and has stood the test of time and it can explain complex things significantly better than Aristotelian logic. In this blog, I shall be applying this to a highly debated issue among academics, researchers, economists, investors and businessmen.

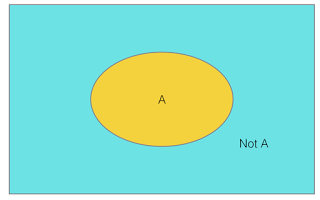

This is unresolved in my opinion not because of lack of evidence because of shortcomings of Aristotelian logic. In that logic, either something is true or it is untrue. It states that there are only two possibilities- white or black, excluding both or neither.

"Figure 1: Venn diagram illustrating binary logic

"

What India can bring to improve the Efficient markets hypothesis is not more evidence for or against, the West has already done enough of that, but superlative logic and logical systems which can explain more complex phenomenon

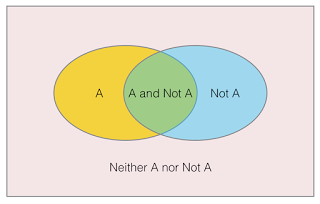

The four sided negation - Chatuskoti can explain Bogle and Buffett and give a better, richer and nuanced understanding of stock markets and Efficient Markets Hypothesis. Here is an excerpt from a very good post on this topic and you can read more here on Chatuskoti

Figure 3: Venn diagram illustrating Chatuskoti, or the 4-sided negation.

This 4-sided negation creates four distinct zones in the universe Ω. With increasing knowledge, our understanding of all these 4 zones increases, but the zone of “Neither A nor Not A” may remain forever. This is because we may predict that we don’t know something about the universe, but we may not be able to express exactly what it is that we don’t know. Please note that this limitation is due to two things: (1) our understanding of the world and (2) the limited expressibility of language. Even if we allow humans to be omniscient (in whatever finite context for Ω specified by our problem), the ambiguity in the language may never be resolved."

If we apply Chatuskoti and use the data already available, we will come to the conclusion that the market is thus both inefficient and efficient at the same time. Let me explain.

The Market is inefficient for two categories of people - those who can identify reasons why some stocks are seriously wrongly valued - arising from industrial, economic , behavioural, legal or policy reasons and find ways of making super normal returns from it, in a fully legal manner. Not surprisingly, it is the largely the collective effect of the actions of these people that make the market efficient.

Another is those who can access such people and retain their services at such a fee that a portion of the returns arising from market inefficiency is still left for them after paying their fees. It should be kept in mind that in any society such people are a very small minority and not too many people can indeed beat the market because as the number of active investors who set out to reduce the inefficacy increase the inefficacy reduces drastically.

For rest of all market participants who fall in neither of these categories, the market is efficient and they are better off by not trying to beat it.

So if some one asks you "Is the market efficient ? "- it really depends on the person asking. For example , if you are John Doe or the Common Man from RK Laxman cartoon it is efficient but if you are student of value investing and possibly were lucky enough to study in Heilbrunn Center or under Prof Sanjay Bakshi and can put to practise what you learnt it definitely isn't !

Thus the stated position should be that EMH is both true and untrue. It is inefficient for some kind of players with the requisite skills/competences or for people with access to such skills/competences at a right price and highly efficient for the rest of those who are really in one way outsiders to the game. The highest value to society from this nuanced understanding is that EMH should neither be discarded nor taken blindly and players should take actions appropriate to their circumstances.

It should not be discarded, as discarding it will mean you are giving very wrong ideas to a numeric majority who have no access to those who can beat the market up a garden path.

It should not be accepted blindly as it will mean you are dissuading people with real skills whose work can a long way in actually reducing the inefficiency in markets on a continuous basis and keeping it efficient by telling them it can’t be done.

This nuanced understanding will also help us understand the role of active and passive investing in markets. Paradoxically the parts of the active investing universe that make supra-market returns by constantly exploiting inefficiencies go towards making the markets more and more efficient and make passive investing work !

In my opinion, it is not either or but a right combination of active and passive investing that will make markets efficient.

In one way to can be said that sensible active investors are really the ones keeping the stock in check by constantly following process of selling overvalued assets and buying undervalued ones and ensuring that bubbles don't build in pockets of stock markets and may-allocation of capital doesn't occur.

Lastly the role of such active investors and their social relevance is probably in making it more and more efficient. This can go long way in ensuring that people without requisite skills don't waste their talent and time seeking their fortune in the stock market and actually spend the time producing the things of value in society instead of speculating without any understating of the social, economic, or business rationale and relevance of what they are doing in the hope of getting rich quick.

Before you go, here is a sculpture which is said to be a pictorial representation of Chatuskoti. You can decide it if a bull or an elephant. Is it neither or both?

Bull and Elephant statue at Thanjavur Airavatesvara Temple